One particular area of interest of mine is in tech history, seeing the successes and failures of past tech and imagining alternate timelines where different ideas or products could have emerged.

As a product creator myself, I'm very interested in what it takes to make a Category-Defining Product, the likes of Walkman, iPod, iPhone, iPad, Apple Watch, Apple Airpods, Ford Model T, World of Warcraft, Gameboy, Tesla Model 3, etc. These products are watersheds in their particular product categories, the charismatic megafauna of the product world. Before these products come to market, the concept space may be explored by several not quite there products that diverge in form and UX, but afterwards, other products in the category converge in design and are made in their image, mere deviations or expansions of the category creator's platonic ideal.

This post is written from the perspective of and for other product creators, who often fall into the trap of underestimating the importance of all the other things outside their vision for a product that lead to success. Hopefully by the end you'll have an appreciation for the greater context of your ideas, and when or whether they're feasible given your particular context.

Creating a Category-Defining Product

Making even a moderately successful, let alone category-defining product comes from an integration of many disciplines and considerations that ideas people may be unfamiliar with. There are many obvious factors like having the right insight about users, finding the right use case, selecting the right tech, defining addressable markets, etc, but I'm not going to focus on those. Instead I want to focus on a few that frequently seem to trip up otherwise very innovative products: timing, leverage, scope, and execution.

Timing

For ideas people, it's a tough pill to swallow that product-market fit is not always possible for any given idea at the current moment in time. If you build and sell your product even just a bit too early, you waste capital fighting uphill against a market simply not ready for your idea in today's product form.

Timing things right is hard, and the history of tech is littered with ideas that came before their time. To time things right, you have to line things up in three different areas: Technology, Culture, and Effort.

Timing Technology

When pursuing a new product category, enabling technologies are the pace-setters of possibility. These include battery density, speeds, screen tech, internet bandwidth, software frameworks, etc. You can only unlock certain user needs and opportunities at certain levels of capability, which is why its critical to identify what technologies are on your critical path, how quickly they're improving, and what you need to do to get them over the line to meet user expectations for your given use cases.

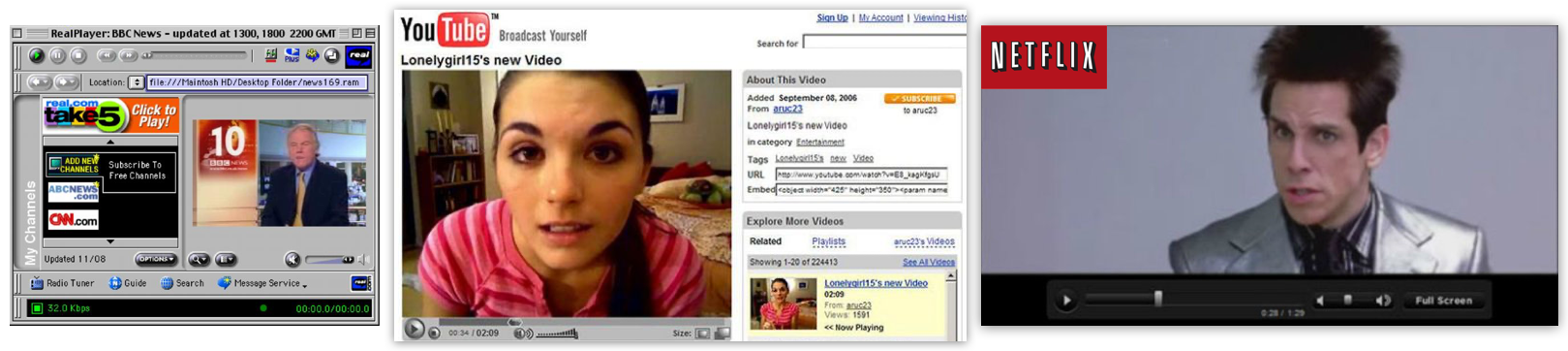

Example: Streaming Video

RealPlayer was an internet media streaming product that started in the mid-90s. It wasn't a leap to conclude streaming was the likely endgame for media even a decade prior, but RealPlayer appeared before network bandwidth and compression algorithms were sufficient to deliver a good enough experience. The result were blurry, laggy postage stamp sized videos at 120-200p resolution. When the dotcom bubble burst, they had little fight left in them to be a meaningful player.

Youtube, meanwhile, smartly timed the falling cost of and increasing speed of internet bandwidth, which in 2005 meant 240-360p resolution. Part of their brilliance was to launch in a unique content category where quality expectations were lower: user-generated videos from the growing point and shoot digital camera market.

Netflix, though, is the real king of timing. Founder Reed Hastings had the foresight to know quality expectations were high for movies, and that streaming would take a while to meet those expectations. So instead of waiting, he began the business with the only internet technology that could meet the quality bar at the time: mailing DVDs. Netflix mailed one billion DVDs before even starting their streaming service, which at that time was just starting to be competitive with DVD quality (480p).

Timing Culture

People need to be ready for an idea. Creators are notoriously bad at anticipating how people might respond to their ideas, because creators are technologists who get excited about possibilities but often have blind spots about how technologies will be used, what factors people care about, where misunderstandings may lie, and how culture will collectively respond as a result. During product development this comes out in which use cases are valued, the form factor of the product, how the product is incorporated into the user's lifestyle, etc.

Being tapped into emerging trends and pivot points in culture is important because the window of what's cool or acceptable is a moving target, and what's uncool now may be acceptable or cool in a few years. It's often other interim products that shift this window, but a great marketing and user education campaign can't be underestimated in reframing ideas to open people's minds.

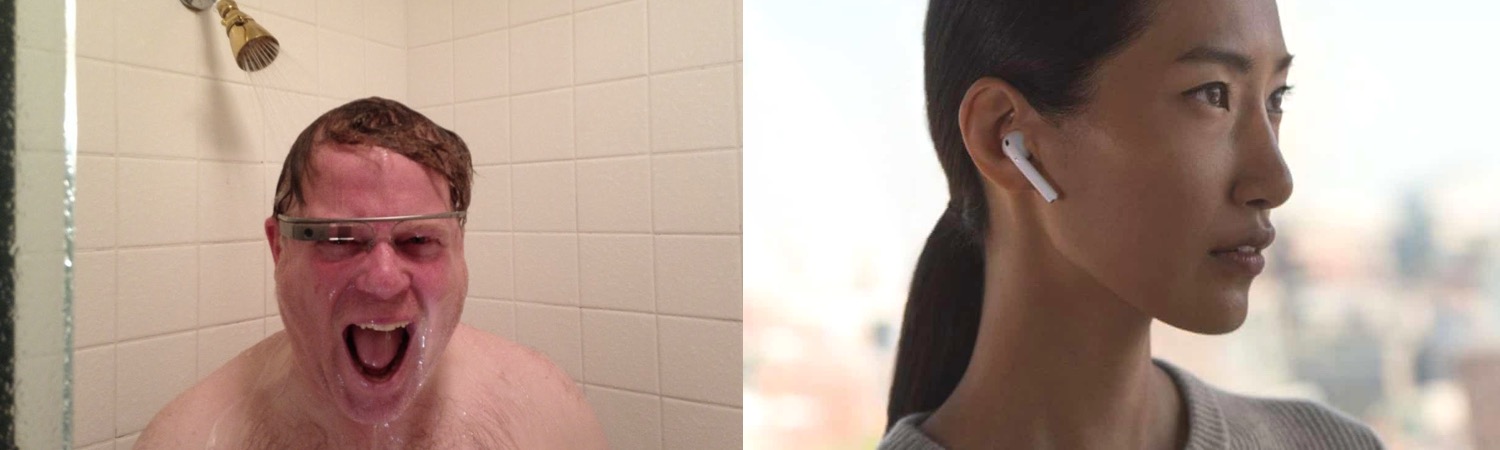

Example: Wearables

Google Glass suffered from almost instantaneous cultural blowback upon launch. Users were deemed 'Glassholes' and were banned from San Francisco bars, due to the always-on recording nature of the product and the dorky engineers and enthusiasts that acted as product ambassadors. The decision to even include a camera was a fatal mistake because of the creep-factor that resulted.

AirPods have been a roaring success despite some initial snark about looking like 'q-tips sticking out of your ear'. They were a natural progression from wired earbuds, and whatever hang-ups people may have had about them were outweighed by the obvious convenience factor and familiarity of design (effectively Apple's existing earbuds design, sans cable). The market was ready for them.

Timing Effort

Another important consideration and a particular sensitivity for ideas people is that pioneers get arrows in their backs. Creating anything new is a messy process - it takes a ton of blood, sweat, and tears, as well as a lot of social and financial capital, and it starts the clock on technical debt. You have a limited number of risks you can take before you are laden with the baggage of these, where you lose the trust or interest of your team and investors, and/or run out of steam. Sometimes, ideas in their earliest form are also laden with the baggage of bad ideas, say from an investor or sponsor, that are obviously wrong but hard to shake given they were necessary to get the project off the ground.

If you spend a ton on R&D to develop and productize an idea before its time, all you're doing is showing the market how to make something as soon as the timing is right. Others can freely take this work, sans baggage, with new and better technologies, and iterate on your ideas (and avoid your mistakes) with fresh energy and capital.

Example: Personal Computers

The story of the Xerox Alto is legendary in Silicon Valley as a product that showed everyone the future but captured none of it. The Alto was the first desktop metaphor graphical user interface (GUI) computer, built at Xerox's Palo Alto Research Center in the 70s. Full of innovative technologies but costly and large, the Alto languished under Xerox's conservative corporate leadership and few machines made it to market. But it's ideas inspired others, including Steve Jobs at Apple, and the Alto's ideas (even in diminished form) became the foundation for the Macintosh and Microsoft Windows.

Leverage

Next, ideas require business leverage to succeed in the market. Things like brand leverage where you're already trusted in the market and have a history of delivering quality product, the ability to scale manufacturing to meet demand, business relationships and scale to get access to special components or lower component costs, a well-oiled organization with deep talent bench, etc. This is more your standard MBA analysis of strengths and forces, but idea people tend to discount these a great deal. A lack of leverage is one reason why category-defining products are rarely created by brand new startups.

Example: Smartphones

Windows Phone was a huge missed opportunity in leveraging Microsoft's considerable resources. Despite having a mobile OS on dozens of devices for several years before iPhone's launch, Microsoft didn't act quickly to shore up these efforts with competitive UX and modern devices. They couldn't leverage the same level of depth in hardware as Apple, and in software they didn't leverage their relationships with OEMs because they stuck to their existing licensing approach when Google was giving away Android. Finally, in a rush to catch up they quickly deprecated old versions of Windows Phone OS, nullifying any leverage they had with developers who had little interest in supporting a quickly-shifting platform that was increasingly falling behind.

iPhone, on the other hand, is a case study in leveraging prior success, and would not have been what it was without the iPod and Macintosh. Apple leveraged their huge consumer mindshare, savvy in mobile device manufacturing, supplier relationships, and iTunes from iPod, and leveraged the powerful software underpinnings and dedication to UX from Macintosh. Apple then went to AT&T and negotiated with that leverage to exchange exclusivity on AT&T for complete control of the UX (avoiding carrier-bundled 'shovelware') and unlimited data plans - things no other phone before and few since have achieved.

Scope

Another thing that separates category-defining products from others is how smartly and tightly they're scoped. In other words, which features they determine make smart complementary value propositions for a compelling launch, and which much larger list of features they save for the future.

When a category-defining product comes out, it becomes the first meaningful representation of a much broader space of ideas and possibilities in the category. To accomplish this, a category-defining product must meet two difficult hurdles: it both finds a platform that could encompass and enable those possibilities, and it smartly identifies and nails the first few steps to reach them.

Scoping for Platform

Platforms are a set of future opportunities a product can leverage to capture the possibility of the new category. They act as flywheels that confer a lasting advantage in the market.

Platforms encompass both internal capacities of the company and the ecosystem the company's product lives in. Sometimes the development of the ecosystem is already underway, and is just waiting for a product to come along to leverage it (such as the open internet with Google). Once the category is defined, the ecosystem's value will still primarily accrue to the leader as long as they remain competitive.

To scope for a platform means you identify the capacities and ecosystem necessary for your product to establish itself, and have a clear plan for creating and leveraging those opportunities.

Example: Cars

Ford's Model T famously came in one color: Black. Its early iterations were as simple and un-customizable as a car could have been in an era when other cars were often entirely bespoke. Ford both identified the key things people wanted in a vehicle and built only those, and used that first step to build toward a larger platform of both internal capacities like advanced assembly line manufacturing and the external ecosystem of a nationwide network of highways, repair shops, and gas stations that were supercharged as a result of the introduction of the Model T.

Tesla vehicles today represent that same level of simplification and focus in the electric car category. Tesla identified only the things people wanted in a vehicle (including price) and cut out hundreds of extra parts to simplify production. They also changed the basic formula settled on by other manufacturers, favoring continuous improvement (including OTA software updates) over model year distinctions, and selling direct instead of through dealerships. Their compounding successes let them build out a larger platform of battery manufacturing capacity, charging stations, and other electric car technologies that keep them far ahead of the competition in this rising category.

Scoping Only the First Steps

In new and emerging categories, companies struggle with picking which use cases to get right, because they're often too focused on reaching all the possibilities and establishing a platform in the category before they earn their place in it.

Example: Augmented Reality vs Smart Watches

Magic Leap is a billion dollar effort in AR that recently released their first device, which is bulky, expensive, and limited in capability. What they and everyone else in AR have yet to show is a clear and achievable first use case that will unlock mass-market appeal, sometimes called a 'killer app'. Lacking a killer app, they're stuck creating a general-purpose product. In AR, this means focusing on fidelity, embodied in high resolution, wide field of view visuals, powerful processing, and compelling input methods.

Creating general-purpose hardware is fine for R&D but a misguided effort when it comes to launching product, and looks a great deal like multi-function pen computing devices in the 90s. My belief is the winner in AR will be the company that builds a great product despite meaningful fidelity, where more achievable tech like a basic heads-up display is enough for the target use case. I've written about why I think Minecraft Earth could be AR's first killer app, namely by making the job of AR hardware to simply deliver low fidelity place-based notifications rather than chase interaction and high fidelity visuals.

In a related category, Apple Watch took a different approach. The very first Watch was slow and extremely limited in capability, but found immediate success because it correctly identified the killer app: notifications + fitness. To build a complete experience around those, it needed iPhone's screen and interactivity, and so it coupled the hardware with a new Health app, much like iPod did with iTunes before. Those were enough to define the category and create a platform for all the later possibilities like cellular, gps, standalone operation, EKG, etc which launched over time as the technology allowed.

Scoping the Complete User Experience

Besides scoping for first steps and platforms, another important part of scoping is to scope the complete user experience of the product, rather than just a particular facet in isolation. This is especially challenging because envisioning a complete user experience is inherently cross-functional; it's usually the combination of hardware, software, design, marketing / trendsetting / user education, early growth efforts, etc. And that means the organization has to be particularly good at coordinating effort.

Example: Wireless Headphones

Plantronics Voyager is a bluetooth headset that contemplates only what its like to be using the headset and ignores the rest of the product experience. Taking the headset out of its case and putting it back in requires two hands and close attention, it is awkwardly shaped and its case is fragile, it works solely for calling and not general purpose device audio, etc. It's likely the Plantronics team was a hardware team solely focused on optimizing sound fidelity, and it was assumed users would just deal with the sub-par experience outside of that.

AirPods meanwhile were designed around a complete user experience. Pairing is as easy as opening the case next to your iPhone. The case can be opened with a single hand in your pocket, wearing them doesn't interfere with hearing outside noises, they are inconspicuous enough to be worn regularly, etc. It's one unified, effortless product experience.

Execution

Lots of high-concept ideas are lousy at the exact details and execution of the idea. Cool, you can theoretically send a fax from the beach, but under what conditions? Only when the clouds obscure the sun and you can read the screen? Is faxing even the right modality to communicate with? Is the UX cumbersome, or does it require a laborious setup and sync process? Its often the little things that separate not quite there products from category-defining products, even when they meet similar feature requirements or offer unique features.

Executing With the Right Quality

There are just some things that shouldn't be made until they meet a certain quality bar. There's always a temptation with technologies that are really really cool to bring them to market as soon as possible, but that fixation on novelty can cause creators to overlook the very real shortcomings of the technology in its current form. Some companies like to 'innovate in public' with prototype products, however category-defining products are rarely made by these companies. Quality means a product that works in real-world use cases rather than just controlled conditions, and includes various fit & finish aspects like durability, reliability, predictability, consistency, intuitiveness, graceful failure, look & feel, etc.

Example: Foldable Phones

Samsung's Galaxy Fold and Galaxy Z Flip as well as Motorola's Razr seek to differentiate themselves from the crowded smartphone market by introducing new form factors that folding screen technology allows. However, while great in concept, they struggle to meet the high quality bar set by existing phones. Their complex hinges, noticeable screen creases, and suspect long term durability show they're not ready to take on and win the market.

Executing With the Right Constraints

It's also possible to do a great job on details, but within the wrong constraints. To quote Peter Drucker:

"Efficiency is doing things right; effectiveness is doing the right things."

This trap of efficiency without effectiveness is often the case with companies made up of talented creative types who do not have the kind of leadership that can act as a dispassionate reality check on whether the end product can ever deliver on the desired experience and sustain their position. The same creative spirit that brilliantly solves problems is going to have a blind spot on problems that aren't solvable, especially when knowledge of that is gated by people on the business side who say 'trust us' and own the understanding of users and market.

Two types of constraints in particular a lot of companies mess up are technology readiness and strategic position. In the latter, a product may unwittingly try to do something not 'in their lane', often things like trying to solve a need at the platform level when they're merely an app on that platform. This inevitably leads to disintermediation by platform owners either knowingly (being 'Sherlocked') or unknowningly as they execute their platform strategy. I've been burned this way at one of my own startups.

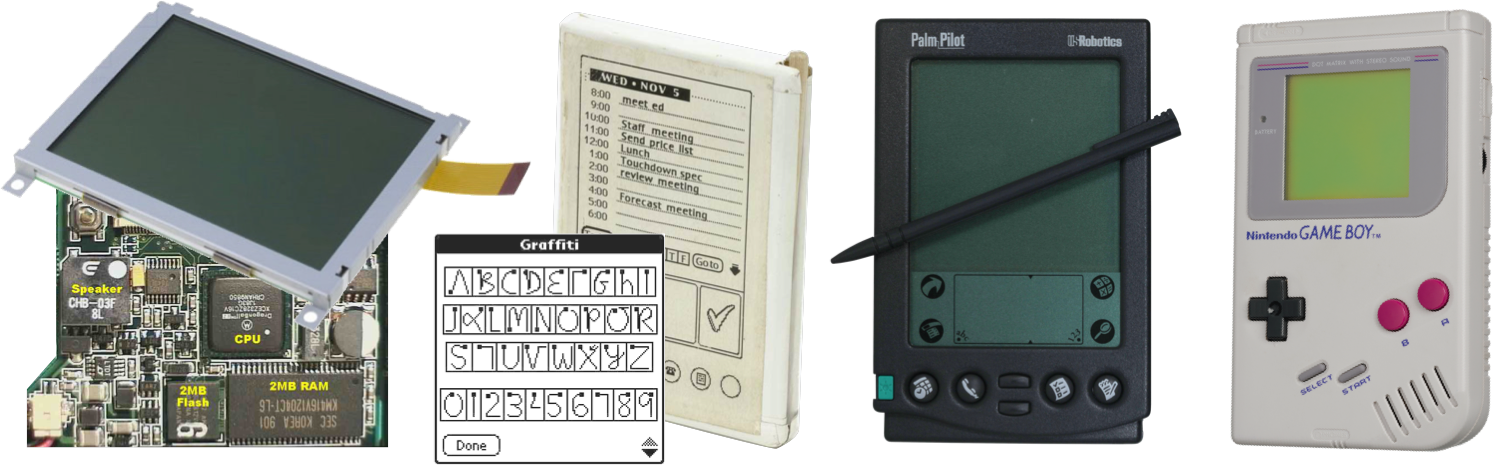

Example: Personal Information Managers vs Portable Games

Palm Pilot and other pen-based PIMs in the 90s like the Apple Newton lacked the enabling technologies to make a competitive experience for the scope of use cases people expected - usable outdoors, pocketable, quick unclunky data entry and retrieval, automatic syncing with computer, etc. Paper and pen organizers were well-established among those that lived by their calendars, and set the bar for simple usability that the available technologies couldn't meet, despite a lot of clever (and prescient) design work. Many of these efforts did a fantastic job with the pen and the dim greyscale LCD, but those were the wrong constraints, as they limited where and how the product could be used. Palm Pilots sold well for a time, but did not have lasting impact.

Nintendo GameBoy, on the other hand, succeeded within almost identical technical constraints by focusing on an entirely different segment and use case where size, speed, and screen technology didn't work against them as much. Kids (and many adults) were more willing to work with the device limitations because portable gaming was new and unique. And the rather basic technology of the GameBoy gave it a particularly important advantage - extremely long battery life. It ran circles around technically superior competitors like Atari Lynx and Sega GameGear, outlasting them by 20+ hours. The goal was fun on the run, and hands down GameBoy delivered that best.

Conditions for Greatness

It's telling that category-defining products tend to come from very few organizations, those who have internalized the processes and conditions necessary for creating great products. Business-wise, category-definers are worlds apart from those that follow in their footsteps. They have to be well-run enough to wisely use leverage to secure lasting advantage. Creatively, they operate from first principles and are comfortable with creative risk. They have long term outlooks, seeing the critical path and key factors that will realize a vision. They iterate a lot and throw out ideas that don't meet their standard. They say 'no' more than 'yes' and seek to remove the extraneous. They don't half-heartedly launch products; they're all in. They have the patience to not always being first in a category with a product, they wait to be right and best.

Companies that don't create category-defining products tend to operate differently. They chase the sugar-high of first to market even if the resulting product sucks. They're often short-term thinkers and focused too much on external events and competitors, lacking confidence and trust in their own ability to identify opportunities. They yearn to add a differentiating feature or two but usually fail because they lack the capacities and conditions to gestate new, often risky undertakings. After a category-defining product emerges, they struggle to make headway against it and resort to copycat behavior and the compulsion to add more things rather than refine what they have. They accept product and technology compromises that the category-definer identifies as too limiting for mass market appeal. They chase innovation at the edges, and target smaller markets, use cases, and novelties that lack quality or target too narrow an audience.

There's much more to be said about the conditions required for great products to emerge, but I think the most important truth of it is that these conditions are often rare and fleeting, even within companies that have a history of creating great products. As product creators, you need to always be on the lookout for whether the conditions are right, otherwise you're in for a long, hard, likely fruitless journey.

Other Examples of Failures

Tech is littered with examples of what could have been stories. Some include:

- General Magic, Windows Mobile, and Apple Newton in smartphones/tablets

- Delta Clipper in reusable rockets

- GM's EV1 in electric cars

- Habitat and Ultima Online in massively multiplayer games

- Second Life in virtual third place hang-outs

- Xerox Alto and Amiga in personal computers

- Friendster and MySpace in social networks

- Flickr in photo sharing

- Pets.com and Kozmo in ecommerce and on-demand delivery

- Nintendo VirtualBoy in VR

All of these products demonstrated fresh and sometimes prescient ideas about the future, and all developed technologies that put them ahead of competitors, sometimes years ahead. Some of these were moderate successes for a time, but many failed outright. None defined their respective categories.

The EO Personal Communicator

One story in particular I want to do a deeper exploration of is the EO Personal Communicator by AT&T, called "the iPad of the 90s" by Input Magazine. The EO is a classic example of a not quite there product - one with the right general ideas about the future of computing, but for a variety of reasons (like the ones above), never became a category-defining product.

There are lots of reasons why products fail, and I empathize with the creators of these products, especially if a similar product succeeded in bringing about the ideas you first pursued. But over the years I've noticed a trend in postmortems where creators have the wrong take-aways from their failures. Specifically, the fate of not quite there products is almost always to be remembered with a kind of wistful statement about what they could have been, such as in this quote about the EO:

"We could have had the iPhone 10 years earlier, at least."

I have a particular aversion to these kinds of statements, because they betray an ignorance about just how many things have to line up for a product to be category-defining. It's nowhere near enough to just have an idea, whether represented on a napkin, demo video, prototype, or even in a tangible product on the market. Good ideas are necessary but nowhere near sufficient for breakout success, even ideas that are rather prescient.

How to Approach a Vision

There are three ways companies attempt to bring the future forward before its time:

- Shooting for the Moon

- Incrementing

- Timing the Jump

Shooting for the Moon

The EO Personal Communicator was obviously approaching their vision in an everything right now fashion. I can't see a reasonable future where they could survive long enough to produce an iPhone because the 90s were no time for multi-purpose mobile devices. They made a critical mistake out of the gate, taking a costly, bleeding edge approach to their product while targeting a kitchen-sink of use cases. They'd never previously built a product that they could leverage, and the technologies available at the time were inadequate for even a fraction of what they were attempting to achieve. And we haven't even hit on how nascent the internet was, and how it wasn't yet an ecosystem that could be leveraged to enable other technology-mediated services.

It's not like we lack other examples. General Magic, Apple Newton, Windows Mobile, and Palm all barked up the same tree, and all failed because their products cost too much, did too little, and never seamlessly integrated into people's lives the way the creators envisioned they would.

Even assuming they had strong leverage and ability to execute, 90s tech just wasn't sufficient to produce the cost-effective featureful mobile product that we've come to know as the smartphone. There was no path to market and no sustainable business in it at the time, despite technologists rather accurate visions of our mobile future.

Incrementing

The only sane approach in 1993 was to be a Nokia or Motorola - sell a simple product that does one thing (calling) well. If they'd started in 1998, maybe they could have been a RIM Blackberry and done two things (texting and calling) well. A few years later they could have made a high-end Palm- or iPod-like product that did three things well (texting, calling, and music), but it would have cost a lot.

Nokia, Motorola, RIM, and Palm were operationally great companies at these times. But even world-class execution over an extended period of time would have only produced these mostly forgotten preludes to the product that DID define the category, because the category simply wasn't ready to be defined.

One of these products could have kicked off a flywheel that eventually led to the smartphone, but that would have required a lot of luck, long-term R&D investments, and an extreme willingness to move on from past efforts. Two limitations in particular emerge with an incremental strategy: tech and concept debt and customer expectations.

Tech and Concept Debt - Incrementing means launching several versions of products that sustain you and inch you closer to your vision. However, each of these products can only be launched within the constraints of the present technically and conceptually. The set of details that come to define your early product will inevitably wind up changing as tastes change and the concept space evolves. Therefore if the time between v1 and your long-term vision is too long, tech and concept debt can be overwhelming, because choices made years before in very different constraints need to be entirely re-thought.

Customer Expectations - Incrementing also creates customer obligations and expectations that are very difficult to escape. Early versions of products may appeal to an entirely different segment of customers than the ones you want to ultimately reach. The ideal case is each new version of a product grows the market, but if the category is not yet defined, you can wind up getting stuck with customers who want things that drive you down the wrong evolutionary branch.

As a result of these its natural that companies will struggle to switch to a new evolutionary branch or radically new conceptualization of the idea even if new technologies allow it, due to sunk costs, internal politics, and the risk of losing existing customers. Given these very real potential scenarios, it's probably better to simply pursue a different market where capacities and leverage can be built, and shift when the time was right.

Timing the Jump

One example of the downside of incrementing toward smartphones was hardware keyboards, which were central to the appeal of devices like the Blackberry, but were the wrong evolutionary branch that blinded device manufacturers to other approaches.

Another example was the operating system. Rather than build up from a mobile OS as RIM and others were, Apple waited until mobile hardware was almost powerful enough to run a proper computer-based OS (Mac OS X) and cut it down to size, as John Gruber points out:

Loosely, the path of all consumer electronic categories is to evolve as ever more computer-y gadgets, until a tipping point occurs and they turn into ever more gadget-y genuine computers. The sample size (in terms of product categories) is small, but Apple seemingly tries to enter markets at, or just after, that tipping point — when Moore’s Law and Apple’s ever-increasing engineering and manufacturing prowess allow them to produce a gadget-y computer that the computer-y gadgets from the established market leaders cannot compete with. That was the iPod. That was the iPhone. That, they hope, is Apple Watch.

Now, could an iPhone have come out before 2007? Possibly, but not by too much. Category-defining products tend to make key bets on inventing or securing enabling technologies that allow them to accelerate the time-to-market in their category by a few years. For example, iPod's 1.8" hard drive, Tesla's battery pack, iPhone's multitouch and OS.

Summary: The Three Approaches

The iPhone is an example of timing the jump. Apple had the benefit of seeing many early failed efforts that nonetheless had the right general ideas. They identified the key use cases and quality levels they needed, identified the enabling technologies to meet those needs, and built the right product.

RIM, Palm, and Nokia are examples of incrementing. They got stuck with a evolutionary branch of the smartphone that gave them a false sense of success, and under-invested in technologies that would bring them into the future. This isn't to say incrementing isn't sometimes a good approach, but in the case of smartphones, it's hard to argue it was the right strategy.

And the EO Personal Communicator is an example of shooting for the moon. They didn't understand the market need and opportunity at that given time, lacked leverage in their position in the market, failed to intelligently scope features and use cases, and lacked the capacity to execute on the right things in the right way. Like Icarus flying too close to the sun, they were doomed to fall from the sky because they tried to do too much, too soon.

Wrapping up

I hope this was helpful for those of you out there that are product creators and ideas people. Making anything new is hard, making best-in-class products is orders of magnitude harder. It's so easy to get consumed by vision and lose sight of all the realities that lead to success or failure. I'd hazard this is likely the primary reason why ideas people fail. Hopefully with a bit more awareness of these factors, you'll be better equipped to build our your ideas and find success.

If you like this please say hi to me on Twitter. For other inquiries you can email me at my firstname lastname at gmail.

Other reading

Some other articles I've enjoyed reading on the subject are:

- Nintendo’s Little-Known Product Philosophy: Lateral Thinking with Withered (“Weathered”) Technology - how Nintendo uses older tech in new ways to define categories